The Google Ads Auction Exposed: Antitrust Trial Revelations – Part 1

The U.S Department of Justice recently took Google to court. It accused the tech giant of monopolistic practices in the search engine market. This landmark case billed as “the most important antitrust trial of the 21st century” offers us a rare insight to how Google’s ads auction really works. Top execs from the company were put under oath to share all of Google’s juiciest secrets.

Why The Case Came About

The case was initiated back in 2020. It centered around the fact that Google pays around $20 million annually to Apple to be the default search engine on their devices. The state says this gives them an unfair advantage.

Google accountS for about 90% of all search engine traffic. The government is arguing they have stifled competition and engaged in monopolistic behavior, since even huge competitors like Microsoft (Bing) can’t seem to crack the search market.

Rebecca Allensworth of Vanderbilt Law School described the trial as “the most important decision and the most important antitrust trial of the 21st century.”

True to its billing, the case started peeling back the onion layers at Google. It gaves us some fascinating revelations into how the company works to drive forward advertising revenue.

Behind the Curtain: Google’s Revenue-Driven Focus

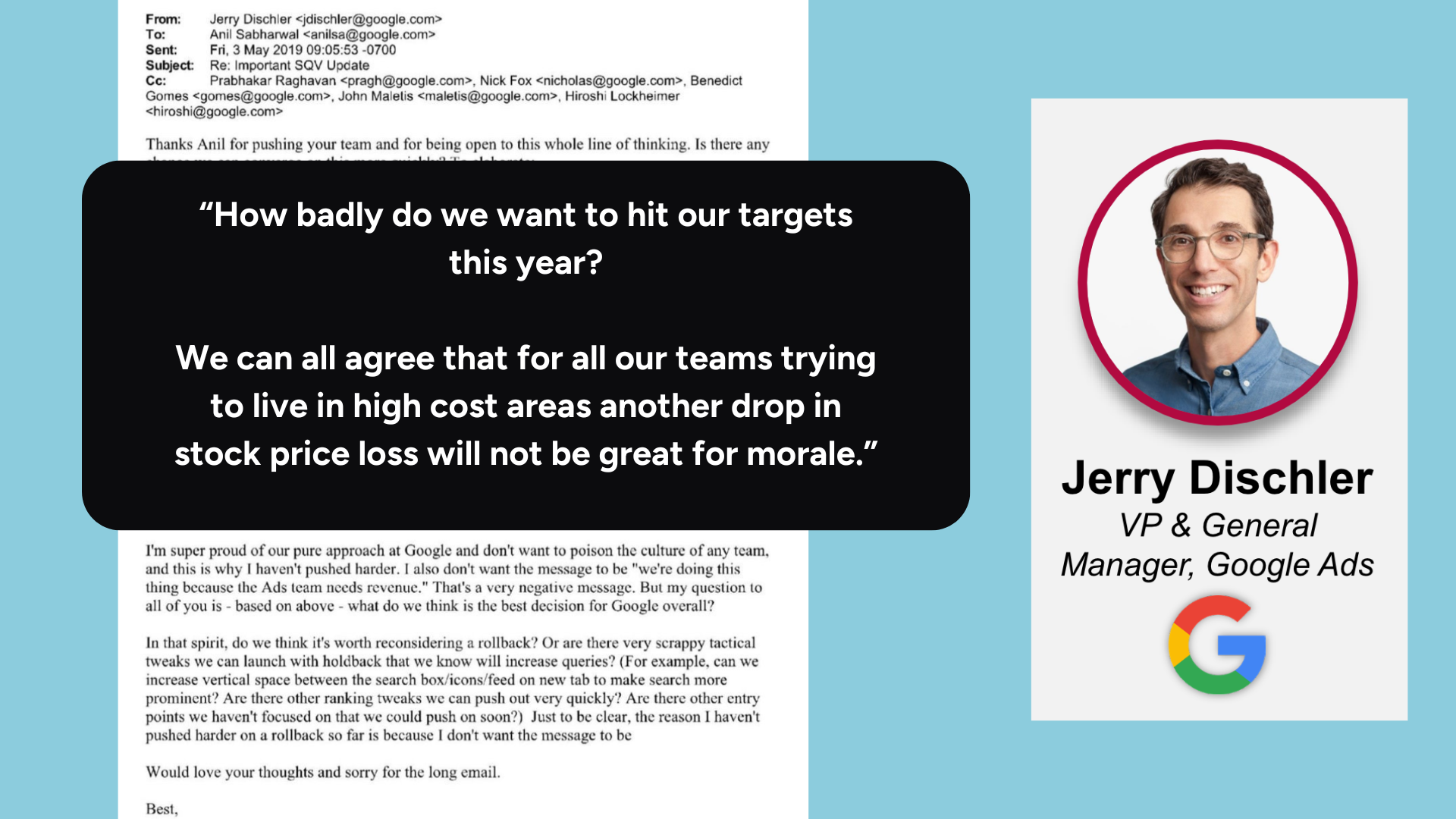

Internal emails shown in court revealed a relentless focus on increasing revenue at the company:

That’s not surprising given that they’re one of the world’s largest publicly traded companies. Nonetheless, it’s a far cry from the original vision of Google “to organize the world’s information and make it universally accessible and useful.”

It’s clear there’s a culture at the company geared towards finding new and creative ways to boost advertising profits.

In a May 2019 email, Jerry Dischler (then head of Google Ads) discussed how his team were “shaking the cushions” to find potential changes to the ad auctions that would ensure Google met revenue targets on Wall Street for the quarter.

He went on to write, “If we don’t meet quota for the second quarter in a row and we miss the street’s expectations again, which is not what Ruth (Chief Financial Officer Ruth Porat) signaled to the street, we will get punished pretty bad in the market.”

He went on to say the following:

“I care more about revenue than the average person but think we can all agree that for our teams trying to live in high cost areas another $100,000 in stock price loss will not be great for morale, not to mention the huge impact on our sales team.”

In court Dischler said his goal was “to get creative so we could meet our quota.”

Sacrificing quality for profits

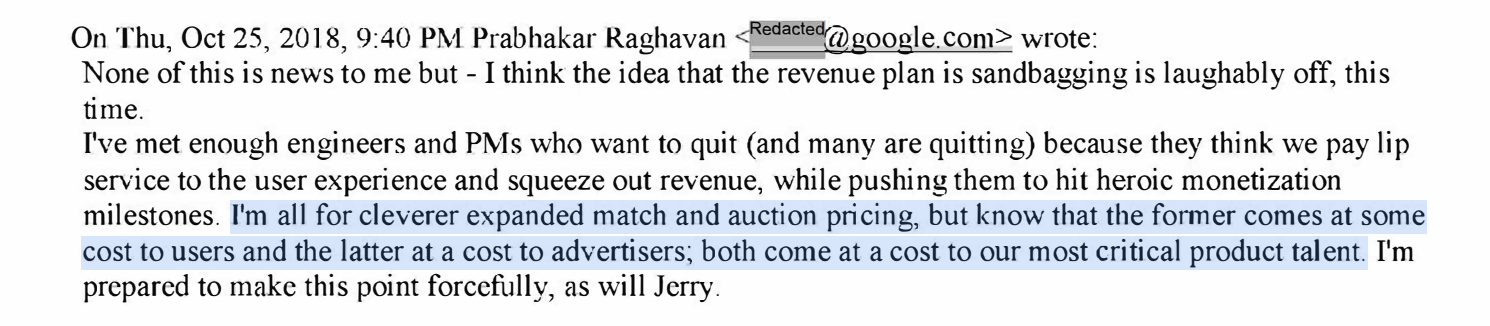

An email exchange was leaked between Mr. Raghavan (now Google head of search) and then-VP of Finance, Carlos Kirjner, who was pushing for a more aggressive revenue plan for the Ads team:

It appears increased focus on ad monetization goals cost Google some of their top engineers.

Mr. Raghavan stated, “I’ve met enough engineers and PMs who want to quit (and many are quitting) because they think we pay lip service to the user experience and squeeze out revenue, while pushing them to hit heroic monetization milestones.”

Manipulating the Google Ads Auction

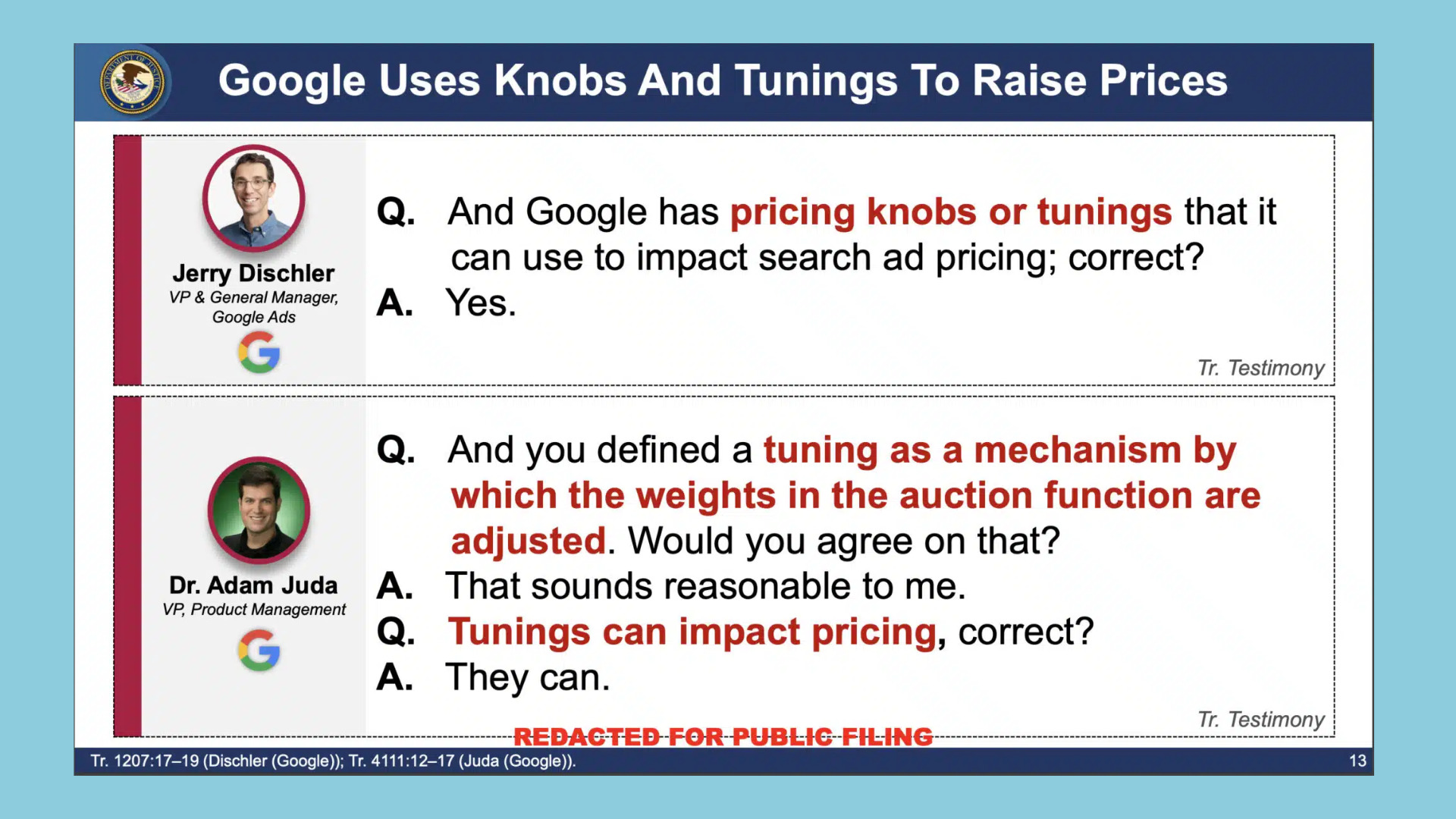

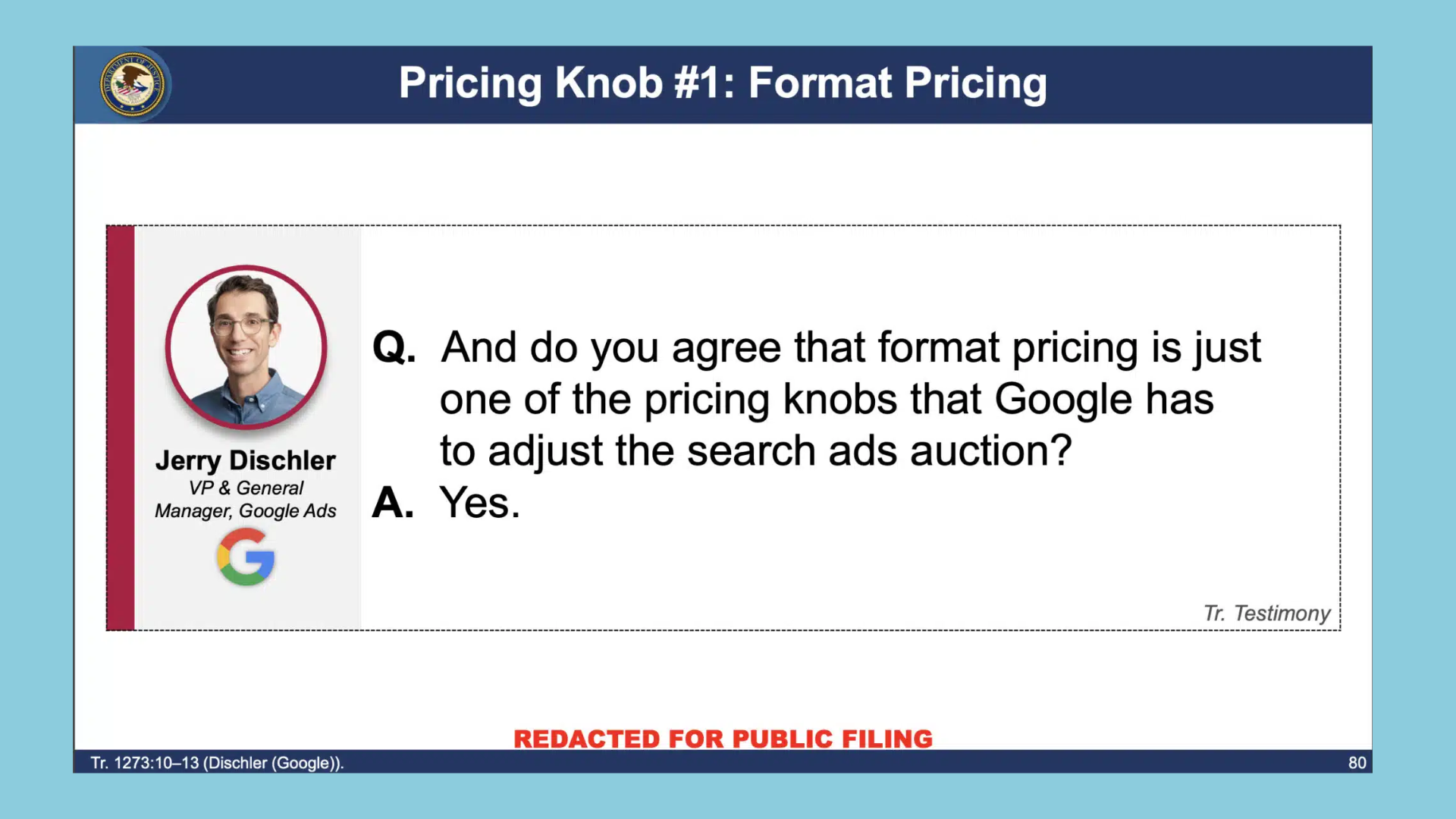

The most startling revelation for advertisers was that they admitted to influencing the outcome of Google ads auctions.

A slide from the DOJ’s closing statement reveals two senior Google executives discussing ad pricing manipulations:

We see here Adam Juda of Google telling the court that “tuning” can impact ad pricing.

These adjustments, referred to internally as “tunings” and “knobs,” allow Google to manipulate ad prices without advertisers’ knowledge.

For example, “tuning,” can raise ad prices by up to 10%, affecting the ROI for advertisers who rely on Google’s ad platform.

Monopolistic Behavior

The DOJ accused Google of unfair practices to manipulate ad prices, by changing the design of the auction itself.

They argued advertisers are not informed about details of how the formula works on how the bids are ranked. They referred to the auction as “a black box.”

We then started to get big reveals on some of the specific ‘secret’ projects that Google released to help increase advertising revenue.

Project Momiji

This project (which sounds like the name of a covert military operation) launched in 2017.

It involved artificially inflating the bids of runner-up advertisers in the auction. These inflations resulted in a 15% increase in the bid amounts for winning advertisers. This practice was not disclosed to advertisers, effectively leading them to pay more than necessary.

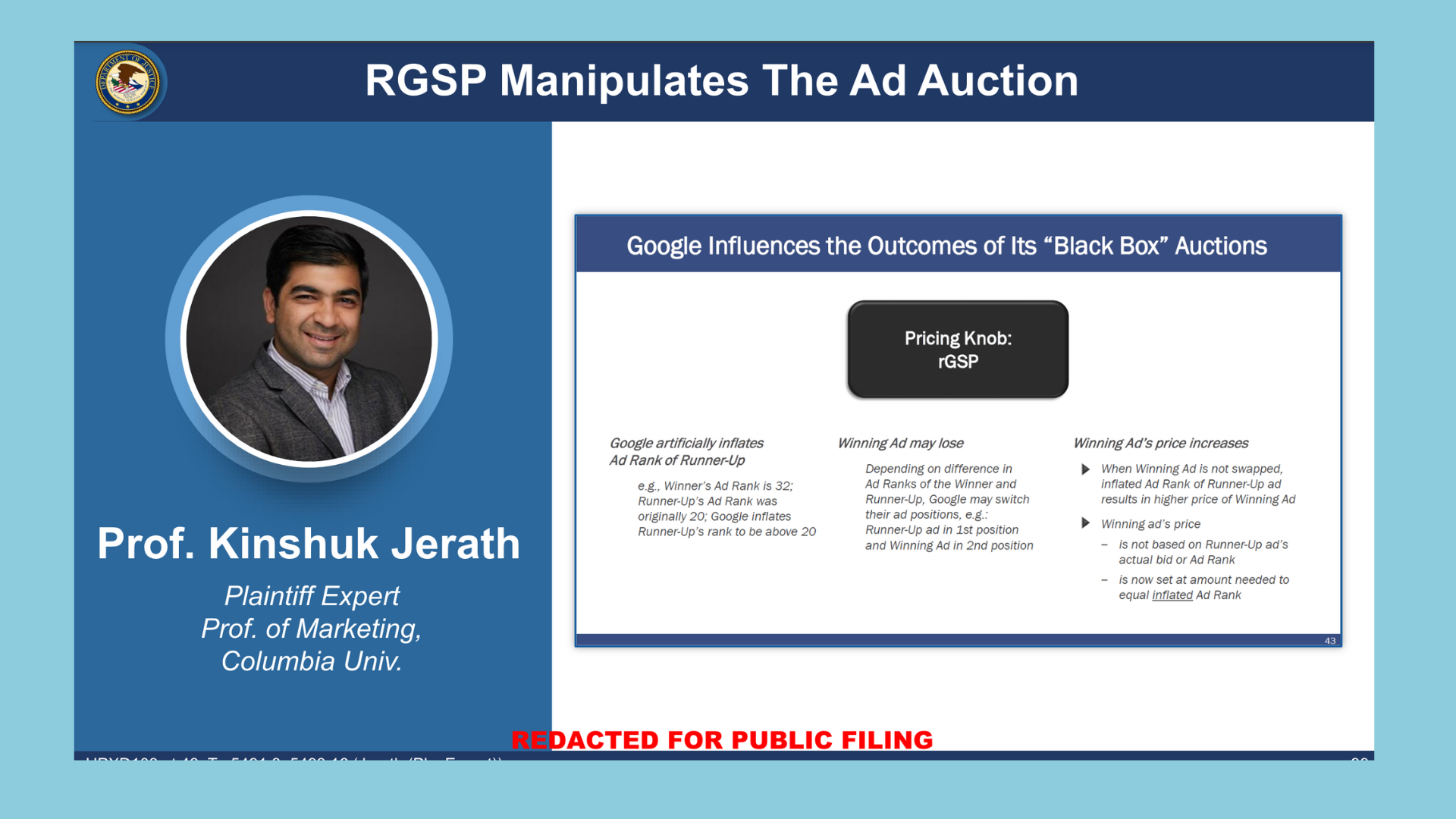

Randomized Generalized Second Price AKA “RGSB”

Implemented in 2019, RGSP is an auction adjustment that sometimes favors the second-highest bidder to incentivize higher bids overall.

Google referred to this as a way to raise prices (shift the curve upwards or make it steeper at the higher end) in small increments over time, effectively inflating ad prices without improving quality.

Google executive Adam Juda was revealed to have said the following on the subject:

“If I have to say ‘we randomly disable you if you don’t bid high enough,’ I’m going to have another bad year at GMN [Google Marketing Next].”

“It was “possible” the auction winner would have to bid 3.7 times higher than the runner-up to avoid swapping.”

Ultimately, the only way to avoid RGSP is to increase your bid.

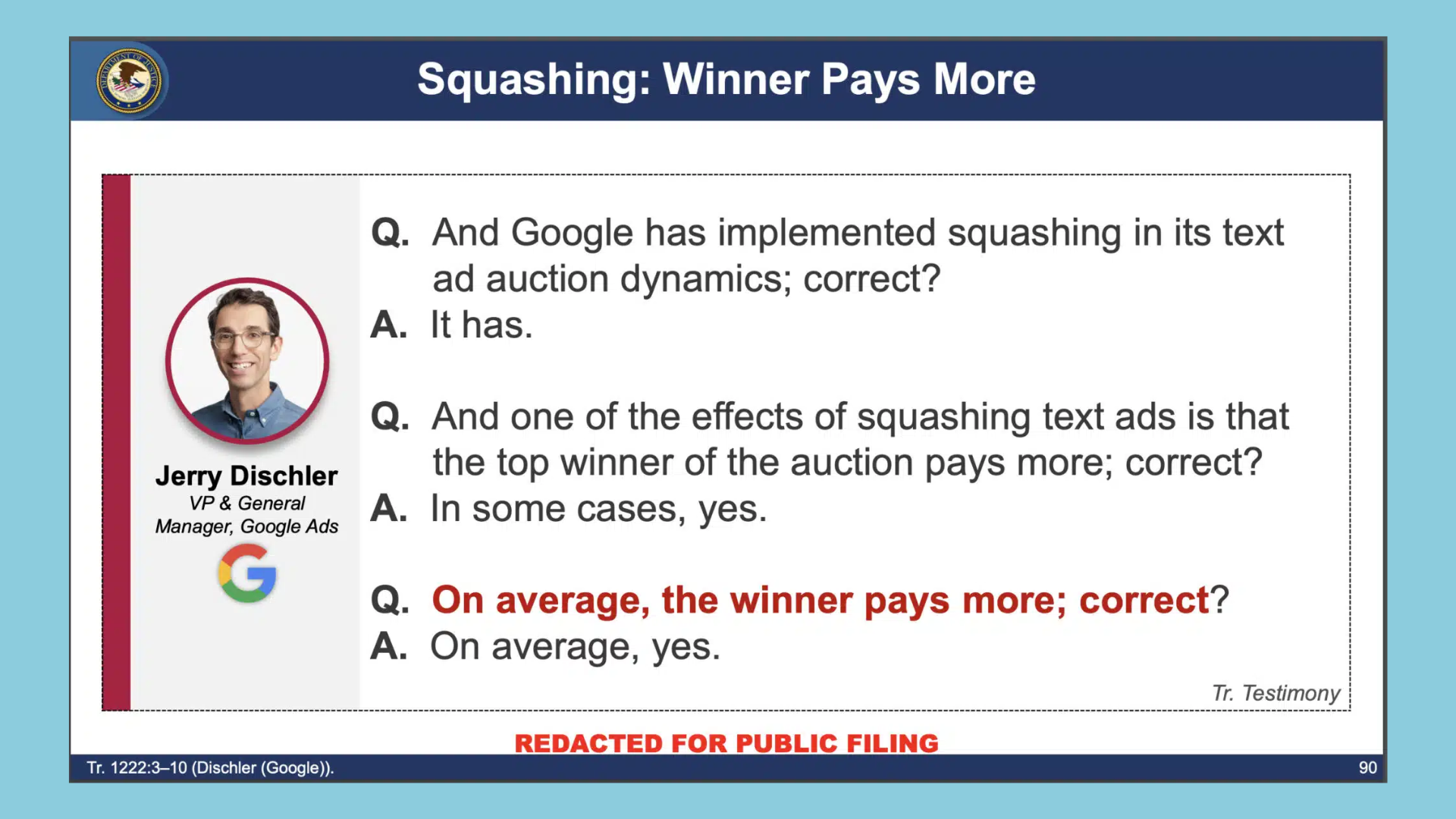

Squashing

In addition, we see another mechanism used called “squashing” which raises the price for the highest bidder.

These secretive tweaks and tunings have one obvious result – Broader price increases within Google’s auctions, and more revenue for Google.

All of these “tunings” push everything towards a broader price increase within Google’s auctions.

The key thing here is that none of these adjustments were ever made public knowledge. Rather, they were all done secretively behind the scenes, which is what’s most frustrating for advertisers.

In Part II…

We’ll explore in more detail the revelations from the case, and also show feedback from the broader PPC community as well.