In November 2014, the client I manage presented me with a very difficult challenge. They needed to increase paid search spend an additional $100K over the amount they originally budgeted for. What made this challenge even more difficult was the timing. The increased budget request was made on day 7 of the month, which meant a new strategy had to be developed and implemented in a very short period of time.

The reason for this dramatic ramp up was simple. Paid search is the only channel experiencing year over year lead volume, cost per lead, & enrollment growth. Due to the success of paid search, we were tasked with dramatically ramping up account spend to compensate for the loss of volume my client’s other marketing channels were experiencing.

This case study discusses our strategy for ramping up the account, the tactics we employed, results, and our key learning’s.

Let’s get to it!

Background

The client I manage is a leading for-profit education company. The schools they own are spread out over 40+ locations throughout the United States. The for-profit education industry as a whole is extremely competitive and has been experiencing year over year enrollment declines. My client has experienced this very issue with their marketing initiatives outside of paid search.

Opportunity

Upon being tasked with the challenge of quickly ramping up account spends, we started off by conducting an audit to uncover untapped growth opportunities. As a result of the audit, two quick win opportunities arose.

- Improve overall impression share.

- Open new traffic and conversion streams within networks currently running our client’s ads.

The Strategy

To meet the challenge set forth by the client, we created and implemented the following strategy:

- Aggressively raise bids and budgets to increase total traffic and frequency of ads being served.

- Expand reach within the Google Display Network. Our analysis identified expanding reach as the quickest way to increase traffic, spend, and conversions.

- Import our best performing ad groups from Google campaigns into Bing.

During the strategic planning phase for this ramp up we shied away from expanding outside Google & Bing. The reason for this was timing constraints. Expansion outside our established networks would of taken time not available to us for implementation and optimization. The client was demanding quick results so we needed put those long-term initiatives aside while we focused on further leveraging our existing program. Focusing on existing initiatives was going to be our quickest route to success in this instance.

The Tactics

Listed below are the tactics we employed to successfully implement our growth strategy.

- Budgets were raised to 1K per day in Adwords. Setting high budgets ensured no impression share would be lost due to spend constraints.

- Raised bids on a sliding scale basis. Keywords not in position #1 with cost per lead at or better than goal were raised to top of page. Bids above goal but still within the acceptable cost per lead thresholds were raised between 5%-15% based on that individual keyword’s specific performance.

- Expand reach within Google Display Network by creating similar audiences ad groups. Similar audiences brought additional clicks and conversions by targeting users with similar characteristics to the traffic being generated from the client’s keyword contextual campaigns.

- Opt Google Display Network into mobile. We set mobile bids at an -80% bid modifier. An -80% bid modifier allowed our client to enter mobile auctions at a controlled pace. Modifiers were either increased or decreased based upon individual campaign performance.

Performance

Below is a summary of results regarding the account ramp up. Key things to note are:

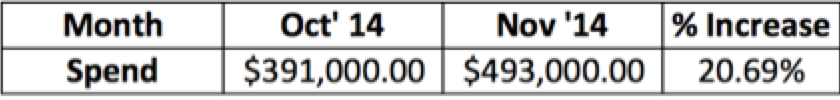

- Spend growth comparisons were analyzed on a month over month basis because the client uses previous month’s spend data to set future budgets.

- GDN results were compared month over month because it was not running year prior.

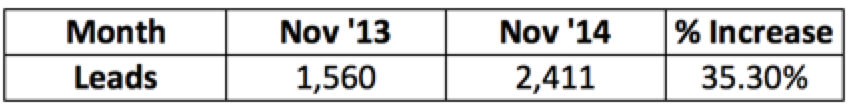

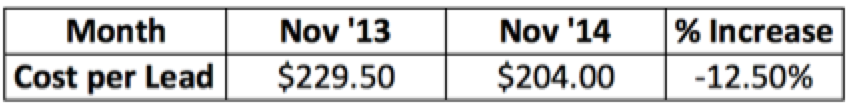

- Overall lead volume, cost per lead, and enrollment metrics are measured on a year over year basis. Year over year comparisons are used to in this instance because seasonality skews results from month-to-month.

Actual Results

- Spend increased 20% from Oct ’14-Nov ‘14. This was important, as we were able to prove that a large, established account could be ramped up quickly.

- Lead volume grew 35.5% year over year.

- Cost per lead improved 12.75% year over year.

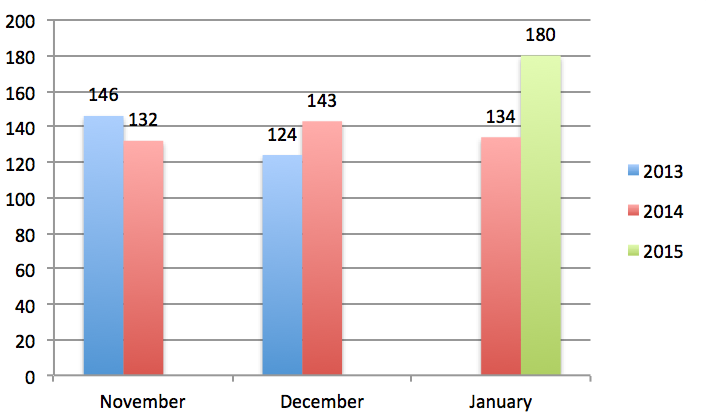

- Enrollments decreased 3% YoY in November ’14. Although enrollments declined initially, the ramp up led to a 13% increase in Dec ’14 and a 25% increase in Jan ’15.

- Overall, lead volume from Google Display Network improved 118% month over month from 87 conversions to 190.

- Similar audiences accounted for 100 additional leads and $40K additional spend

- Opting into mobile at -80% provided 33 additional conversions. Results were mixed. Although additional volume was gained, it came at a very high lead cost.

What Did We Learn?

Not only did the account ramp up achieve its main objectives, some key learning’s were uncovered.

My most impactful learning was that a large, established account could still be grown quickly. My original assumption was that a large account runs out its ability to grow over time and once reaching that point, only small, incremental gains are possible. This exercise both proved my theory to be false and provided a blueprint for cranking up an account when the need arises.

My other key learning has been how to ramp up and structure a Google Display Network account. When implementing similar audiences, we originally added them as ad groups within our core display campaigns. Although these similar audiences ad groups produced a lot of conversions, those conversions were generated at a $100 higher cost per conversion than the account wide cost per converted click average.

Additionally, similar audiences ad groups took up most of the budget and prevented better performing GDN initiatives from getting enough exposure. From this experience, I learned its necessary to break each initiative into its own campaign. Setting up separate campaigns for display select, remarketing, similar audience, etc. provides enough budgeting flexibility for each area to receive enough traffic and generate enough performance data to analyze its success or failure.

Have you had similar experiences such as mine? Would love to hear your feedback.