Last September Google made the announcement that Shopping campaigns would be eligible to appear on the Search Partners network. Shopping campaigns generally tend to see the best conversion rates and highest returns, so this announcement was well received.

As a refresher, the Shopping ads show alongside contextually relevant results on Search Partner sites. These sites include Walmart and eBay. Here’s an example of Shopping ads showing for a “futons” search on walmart.com.

Over the past 10 months, little has been written about the impact this update has made. Fear not, however, as we’ve compiled data from many of our Shopping campaigns across various industries that have been opted into Search Partners during this time period.

Traffic

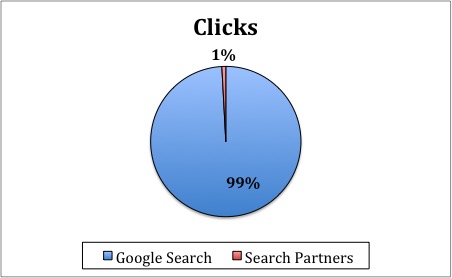

The biggest takeaway is that Shopping Search Partners traffic is extremely low. In looking at nearly 1.8 million total clicks, only about 15,000 originated from Search Partners, or just under 1%. Of the roughly 111 million impressions, 3.25% were from Search Partners. Similar to many text ad campaigns, CTR was lower on Search Partners than Google.

In looking at the individual accounts, the highest Search Partners click percentage was 2.97%. In other words, only in one account did Search Partner clicks account for about 3% of total clicks. In comparison, two accounts’ Search Partner clicks accounted for less than 0.51% of total clicks. Impressions were a different story. Individual accounts saw anywhere from 1.48% to nearly 18% of impressions come from Search Partners traffic.

The cost was also extremely low for Search Partners. Of the nearly $900,000 spent in Shopping, only 0.88% came from Search Partners. Average cost per click for Search Partners was higher by $0.03. It’s possible that with higher bids, Search Partner clicks and impressions would receive a greater impression share and account for a bigger piece of the pie, but most likely only an additional sliver. During this time period, the Shopping campaigns were optimized for profitability, meaning raising bids wasn’t always the right move.

Conversions

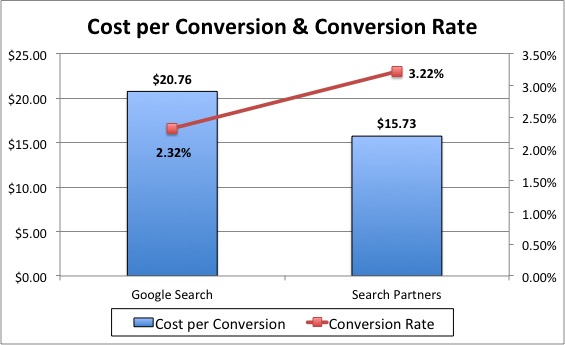

Here’s where the results were interesting. Similarly to clicks, impressions, and cost, Search Partner conversions only accounted for just over 1% of total conversions. However, cost per conversion was lower by about $5 on Search Partners while conversion rate was nearly 1 percentage point higher.

Taking into account that Search Partner conversions were only a small portion of overall conversions, it was encouraging to see that the efficiency metrics performed better than Google Search. Having made this statement, it was about a 50/50 split of accounts that saw better cost per conversions and conversion rates on Search Partners.

Summary

To recap, here are our major findings.

- Search Partner clicks and impressions were a small percentage of overall Shopping traffic

- CTR was lower on Search Partners while average cost per click was higher

- Conversions from Search Partners accounted for about 1% of total Shopping conversions

- Cost per conversion and conversion rates tend to generally be better on Search Partners

Though Shopping Search Partners traffic is low, it’s worth being opted into this network. You will see a small gain in conversions that come at the right cost. Even in those accounts where Search Partner cost per conversion and conversion rates were worse than Google Search, the spend was so low that overall campaigns metrics were barely impacted.

This study beckons another long-running issue, the ability (or lack there of) to view the specific Search Partners and make optimizations. Currently, it’s all or nothing. You either opt into the entire Search Partners network or none at all. It would be beneficial to view the specific Search Partners and exclude as necessary. Even a Search Partners bid modifier would be helpful as a way to still advertise in this network, but bid higher or lower than Google Search.

What results have you seen while advertising on Shopping Search Partners?