Innovell has recently released Marketing On Amazon, a 67-page report based on months of interviews and in-depth surveys. I’ve read the entire report and want to share my top takeaways with you. I’ve segmented my takeaways by roles: marketing technicians and marketing strategists.

Before diving in, I’d like to mention that the first 100 marketers to get this report via Hanapin can get it for FREE. > (opens in a new tab)”>Just go here>>

For The Technical Marketers

In the Amazon algorithm, paid boosts organic

Paid search marketers and SEO marketers are often siloed in their companies. They might meet once per month to share insights, but ultimately, they’re on different teams.

Why?

I’d say the main reason is that paying for ads doesn’t boost your organic listings, at all. The Innovell report explains how this is not the case for Amazon.

The exact opposite is the case for Amazon. Sales are a factor for success in the Amazon algorithm, and advertising directly drives sales and therefore helps a product “rank” organically. It is a very different game, and there is a strong case for the entire industry of Amazon Marketers to be shaped differently than that of Google Marketers, which we explored in our 2018 report, “Major Trends in Paid Search”.

https://www.innovell.com/amazon-marketing-report/

This is an interesting concept: “there is a strong case for the entire industry of Amazon Marketers to be shaped differently than that of Google Marketers…”

I can recall several digital marketing conference sessions focused on “how PPC can help SEO” directed at digital marketing teams where the paid and organic technicians work completely separately. Innovell is suggesting that siloed structure is arguably just plain wrong when it comes to Amazon.

As a matter of fact, all of the winning strategies in the report, from experts who were interviewed for the report, include a combination of organic and paid strategies, working together. (If you want those winning strategies, Just go here>>)

Test. Then Analyze. Then Test Again.

Amazon marketing is evolving almost as fast as Amazon shopper preferences. I was surprised to learn that the experts interviewed rely on testing above all else, to keep up with the quick pace of change.

Over 90% of respondents ticked “Test and learn” as a way to keep up with the pace of change in the sector. Exchanges with Amazon and expert insights in the form of blogs, reports or podcasts or at conferences are next in line, but to a much lesser extent (65%) than what we noticed in paid search (80%+).

https://www.innovell.com/amazon-marketing-report/

One of the experts interviewed even went on to explain that someone else’s advice could even hurt your performance, which is why he focuses on collecting as much data as possible from the get-go and then analyzing that data to make strategic decisions.

Evan also states that “taking every person’s advice on Amazon ads and applying it to your account could really hurt you”. He likes to analyze all the data: “What is the market actually telling you? Being adaptive to all that change. Don’t get stuck in your old ways!”

https://www.innovell.com/amazon-marketing-report/

Return of the 4P’s of marketing

Finally, marketing on Amazon is really a game of classical marketing where all the dimensions play a role and can be optimized for success. We will look at how fully optimizing to price, product, promotion and place is key to successful marketing on the platform.

https://www.innovell.com/amazon-marketing-report/

There’s an entire section in this report that explains how relevant the 4P’s of marketing are in the Amazon marketing space. This really caught my eye because we’ve been hearing lots of “we have to return the basics of marketing” due to Chrome eventually removing all 3rd party cookies. This is the first time I’ve heard someone explain that Amazon is inherently a return to classical marketing, where product, price, place, and promotion are key.

For The Marketing Strategists

Budget for tools to automate the automatable. YES-TER-DAY.

By the end of this paragraph from the Marketing On Amazon report, many of you will sigh, as I did.

The entire platform is driven by technology and, with the strong

https://www.innovell.com/amazon-marketing-report/

growth, the interfaces are also evolving at high frequency. This

means that industry players must constantly keep up with evolutions, juggle with interconnecting interfaces and update their

work processes. The more teams can turn these processes into

automated tasks, the faster and the more efficiently they can deliver results. For this purpose, a wide range of tools emerge, some

for specific functions and some for a wider management of the

process; however, teams in our survey have not budgeted for the

additional cost these tools represent.

Classic.

Not budgeting enough for automation tools early on when the reward for doing so is highest.

If the adoption of paid search and paid social tools over the last 10-15 years are indicators for how we’ll handle Amazon marketing automation, we’ll all wait until it’s a proven, no-brainer to invest in Amazon marketing automation and at that point, the investment will only be to keep us competitive, not to help us actually gain market share.

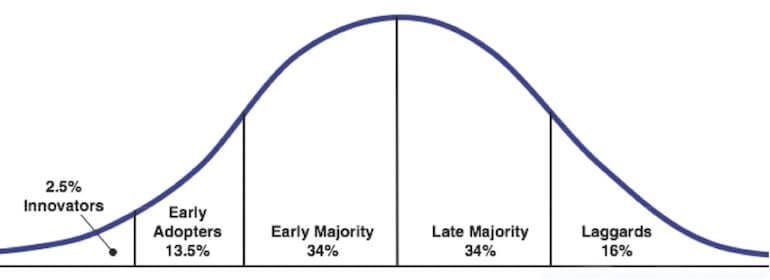

To me, this goes back to the technology adoption curve from The Diffusion of Innovations by Everett M. Rogers.

Based on this curve, roughly 15% of Amazon advertisers will invest in Amazon marketing automation tools early on and will become more efficient and thus more profitable in their Amazon marketing endeavors. The rest of us probably won’t budget for these tools until we start to see more proof (from the early adopters) that those tools are helping and we can use that proof to make our own projections on the ROI of Amazon automation tools. Teams that have faith that automation will increase their ROI and start investing now will reap the benefits and the rest of us will just play catch-up later on. Why do we continue to do this to ourselves?

Though included in the “triopoly”, Amazon Ads is not even close to Google and Facebook

In the digital advertising market, Amazon is also becoming an important player and has joined Facebook and Google in what analysts called the “triopoly”, representing ? of global digital advertising. Amazon Ads has grown to a share of 7.5% of the triopoly, but with 41% growth it is taking market share from its competitors.

https://www.innovell.com/amazon-marketing-report/

This stood out to me as a humbling statistic for Amazon. Yes, Amazon is one of the most powerful companies in the world, but on the advertising side, still not nearly as powerful as Google and FB, who have a combined 92.5% of the triopoly market share.

Don’t let your Amazon teams make the same mistake we made in paid search for so many years…avoid last-click attribution

Attribution is about deciding what contribution each touch point made to the final conversion.

https://www.innovell.com/amazon-marketing-report/

In paid media, we’re all finally in or through the process of adopting more nuanced attribution models than last-click. We know from our own experiences as consumers that people don’t search for a brand out of nowhere and then purchase. There are many marketing touchpoints in a sales cycle and they all deserve some credit for the final purchase.

While this concept has become more popular and tracking more sophisticated, it has also become widely accepted that the default “last-click model”, where 100% of a conversion is attributed to the

https://www.innovell.com/amazon-marketing-report/

last click the user did, does not give a reasonable or just view of the reality behind the user journey.

Among the advanced teams we surveyed, we are looking, however, at a proportion of 55% of respondents who use the “last-click model” for attribution. That means they are exclusively looking at what is happening within the walls of Amazon. As a comparison, when we asked this same question to leading teams in paid search, the proportion for the last-click model was only 14%. We can only conclude that teams on Amazon seem to be working in a silo.

So to me, the big takeaway here is that some companies probably have an Amazon team that operates separately from the paid search and social teams in the marketing department. In those scenarios, the Amazon team probably thinks they’re crushing it, because of all of the sales coming from their Amazon marketing efforts. However, the marketing team that’s generating YouTube brand awareness ads is probably struggling to justify their budget because they’re not seeing the effects their ads have on branded search queries in Amazon, which are driving sales. If you’re a Marketing Director who oversees all of these teams and they’re currently not talking to each other, now is the time to fix that. Get ahead of attribution and learn how all of your channels are driving users to purchase on Amazon.

That wraps up my takeaways from Innovell’s Marketing On Amazon report. Don’t forget that the first 100 marketers to get this report via Hanapin can get it for FREE. Just go here>>

I truly learned a lot from this report and plan to share even more of my takeaways with my team – I recommend you do the same! Amazon is too big for us to ignore, as marketers.