So far, 2020 has been anything but an easy year for retailers. Although stationary trade was hit particularly hard, eCommerce was not the Elysium either: Previous plans had to be changed completely, supply chains and inventories became unreliable and, last but not least, the general economic decline slowed down consumer spending. This also had an impact on advertising. As a result, retailers had to react flexibly in order to keep attracting customers’ attention. A rapid economic recovery cannot be ruled out, but this is not exactly the scenario expected in the U.S. or in Europe. To plan and manage advertising budgets on Amazon in a more targeted and successful manner, retailers should follow these tips and guidelines.

Prepare for the Lockdown Effect and Uncertainty

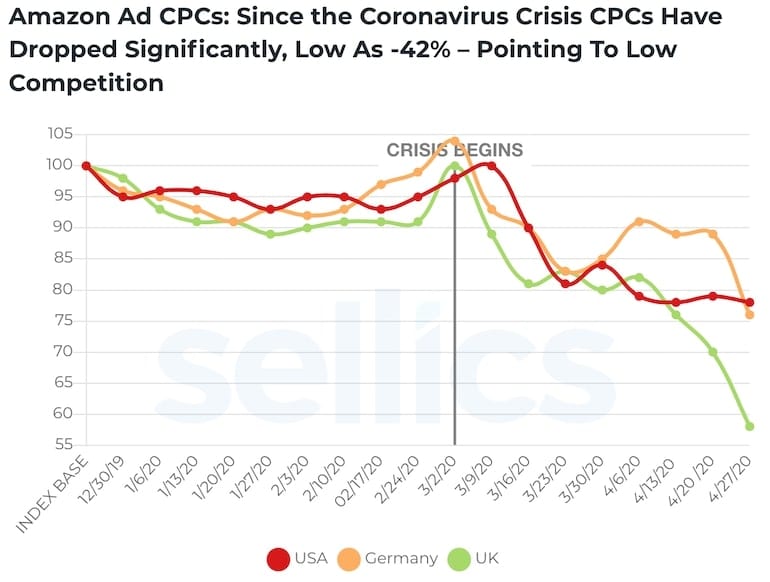

Sellics conducted a

comprehensive, quantitative as well as qualitative analysis of PPC (Pay per

Click) marketing on Amazon in the U.S., Germany and the UK with data from the

beginning and during the peak of the corona crisis. Sellics was able to make a

number of interesting observations: Amongst other things, the lockdown effect

led to an increase in advertising clicks on Amazon, probably due to more

visitors, as many shoppers switched from shopping at brick and mortar stores to

eCommerce. U.S. advertisers saw an increase of up to 29 percent in ad clicks,

while UK advertisers registered a plus of up to 53 percent at the end of April,

compared to the beginning of the year. In addition, the market price for ad

placements decreased probably because of less competition from companies that

cut back their advertising budgets. In other words, the CPCs (costs-per-click)

dropped. For example, in the UK, the CPCs decreased, low as

-42 percent, resulting in a clear improvement of overall performance and ROAS

(Return On Ad Spend) of PPC campaigns.

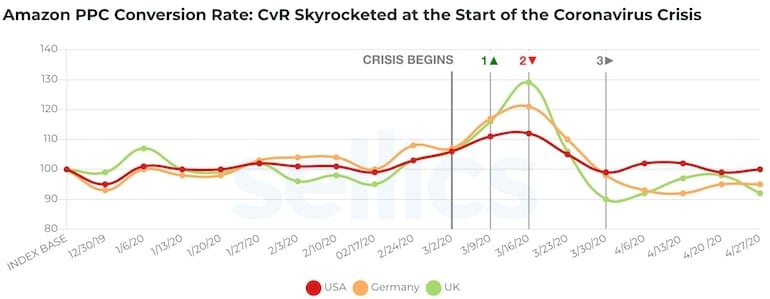

The conversion rate (CVR), i.e. the share of visitors clicking on an ad to make a purchase, peaked in the U.S. around mid-March and then fell back to pre-crisis levels by mid-April. This development can be explained by the following trends: The CVR rose with the increased demand on Amazon at the beginning of the crisis. However, Amazon temporarily restricted the shipment of non-essential items, which meant that the delivery of many goods was delayed. Because many customers expect their products to be sent out immediately, the CVR inevitably dropped. As the logistics situation went back to normal the conversion followed.

Expect An Advertising Boom

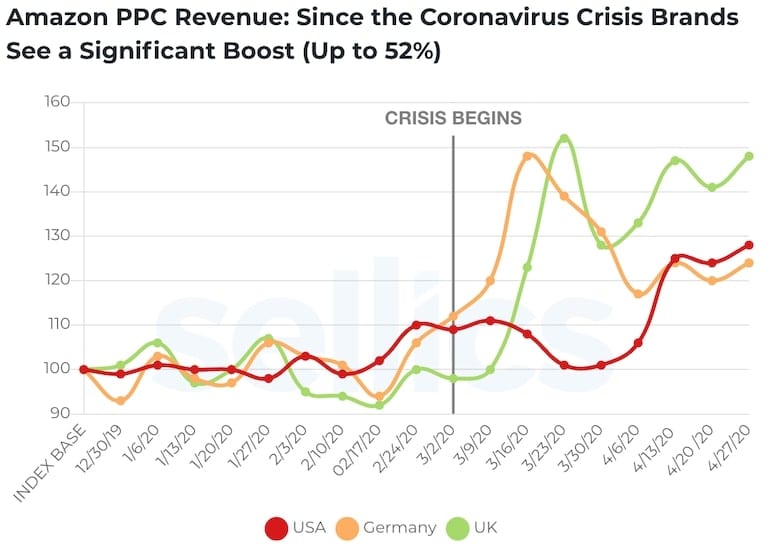

One aspect is particularly exciting: At the beginning of the crisis, according to the survey conducted by Sellics, many online retailers indicated that they wanted to reduce their advertising budget. However, the total volume of advertising spent as well as sales have risen significantly in Germany and the UK since the beginning of March. It needs to be noted though, that the effects on sales were strongly dependent on the product category. For example, some products benefited from the lockdown effect – including devices for remote work or to make time at home easier (i.e. games) – while other items, especially some lifestyle and luxury goods, experienced a significant decline.

Fig. 3: Advertising revenue of all listed marketplaces in the U.S., the UK, and Germany. © Sellics

Seize opportunities

The Coronavirus crisis has definitely taught us something: Burying your head in the sand is not a strategy. The crisis also offers opportunities – dropping click prices for campaigns are just an example. But what should retailers look for in their PPC campaigns? It’s important to keep monitoring the market so that new trends in important KPIs (e.g. conversion rate) or shopping trends are spotted early on and the reaction can be quick.

If retailers know which of their products are trending and can guarantee a well-stocked inventory, they can focus on getting the most out of their advertising campaigns for these products: reallocating budgets, optimizing targets and bids, testing new ad formats and placements, improving product images and descriptions and more. If products are not among the trending items, there might be other approaches. It might be worth it to add new trending products to the selection or, to reposition certain items, e.g. office supplies become remote office supplies. Here again, continuous monitoring is important to identify search trends and be able to adjust keywords (SEO) accordingly.

Optimism and Adaptability are Key

COVID-19 created significant challenges – retailers and brands had to deal with many new situations and shifts. One of the most important lessons was: optimism and adaptability are essential. That also applies to the 4th quarter of 2020. Hopes are high, as a continued increased demand in eCommerce can be expected. Additionally, Amazon Prime Day takes place in October this year. Chances are good that Q4 2020 becomes the ‘Q4 of a century’ for eCommerce. However, there are also many unknowns, because the situation is unique and new. For example, advertisers can only in part rely on experiences with Amazon Prime Day 2019. The other important part is monitoring trends and staying adaptable and optimistic.