In the Fall of 2019, the PPC Twitter-verse was newly abuzz with a question that has been around for as long as the industry has existed: is it worth it to bid on brand keywords? At the time, we wrote about that topic extensively – see Matt Umbro’s “The Great Brand Keyword Debate: What You Need To Consider” for a detailed recap.

As with many questions, the answer to the question of whether or not to bid on branded keywords can frustratingly be summed up in two words: “It depends”. For some brands, bidding on their branded keywords may be an integral part of their marketing strategy. For others, spending on those keywords may be as frivolous as investing in Juicero packs. In this post, I’ll outline a strategy advertisers can employ to help themselves and their clients isolate and measure the value of brand advertisements: geo exclusions.

How The Analysis Works (And An Example)

I’ll be describing how to set up this test in Google Ads and Google Analytics, but we can imagine the basic process working for any advertising platforms that allow you to exclude and measure specific geographic areas. If working in Google Ads, you could set up the experiment by excluding a representative geographic area from the branded campaign whose value you are attempting to measure. If you are advertising in the US, I would recommend dividing the states into two groups of 25 such that their populations are equal and randomly choosing one set of states to exclude from the campaign moving forward.

Once you’ve excluded that geographic area from your campaign, create two segments in the associated Google Analytics account: one for the excluded states and one for the remaining states. Now, moving forward, you can measure the relative lift/decline in your KPI for each group for organic and paid search combined. Importantly, you’ll want to make sure that you’re measuring the period-over-period lift/decrease instead of simply the total amount of conversions for each channel. That should help control for confounding variables that might affect paid or organic traffic in the aggregate.

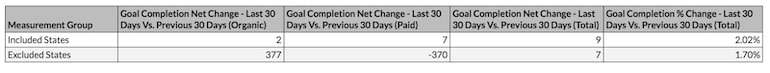

Let’s say, for example, that you let the campaign run with geo exclusions for 30 days, with a group of 25 states that were eligible to see your brand ads a group of 25 states that were not eligible. For the sake of this example, we can imagine that there is only one goal that the advertiser is interested in. To give some texture to this hypothetical, check out the fabricated results table below:

That data would suggest that for the states that were excluded from the brand campaign, the lift in organic traffic conversions almost entirely makes up for the loss in goal completions from paid traffic. In real-world terms, this would suggest that the vast majority of users who would have clicked an ad and converted would have converted over organic channels anyway. In a case like this, one could reasonably conclude that it was probably not “worth it” to run the brand campaign, as its impact on net conversions appears to be negligible.

Other Factors To Consider

The example above is one that simplified to its bare essentials for illustration purposes. In practice, there are many factors that one should consider when setting up this analysis and evaluating its data. Those factors include:

Can you afford a 50% geo exclusion? Perhaps you strongly suspect that paid traffic is a strong driver of branded traffic that you would otherwise miss out on. If that’s the case, then I would recommend starting off with a much smaller geo-exclusion. As long as you’re measuring the net lift/decline, then you should still be able to garner insights from differently sized measurement groups. If the results of the smaller exclusion suggest that branded traffic isn’t really as valuable as you thought it would be, you can always move to larger geo exclusion to gather a larger sample size.

Pro tip: if you want to start off with a single state excluded from your analysis, Illinois has been called the most representative state in terms of demographic makeup. If it plays in Peoria…

How much profit is associated with each branded conversion? Perhaps your analysis suggests that most (but not all) of the paid branded conversions would happen organically if your paid campaign ceased to run. Whether or not you’d want to cease the campaign altogether depends on the profit associated with each conversion. For example, if each conversion brings in $1,000 of profit and the CPL is only $.05, then even missing out on a few conversions could be hugely impactful, and it might make sense to continue to run the campaign at full steam.

What confounding variables might have snuck through? Try as we may, this sort of analysis will never be a perfect, scientific experiment, and as such you’ll want to account for as many confounding variables as you can when interpreting the results. For example,

- Perhaps the branded ads included a special that was not yet reflected in the organic result for your client. If that were the case, the could impact the relative profitability of organic conversions and paid conversions.

- Maybe there were offline advertising campaigns that affected different geos. If the thing that you were advertising was also the subject of a regional TV campaign, for example, that could juice the organic lift in certain areas and may bias your results.

- Even non-geo-specific campaigns on other channels could affect how you interpret results. If there were a huge mailer campaign that affected both your included and excluded geos, that campaign could generate a branded lift so sizable it drowns out the change that you were actually trying to measure.

So, in the end, this sort of analysis is not likely to answer once and for all the question of whether or not spending on brand campaigns actually produces value. But, hopefully, it can induce some data and nuance into your investigations of that question. Each advertiser faces different challenges and opportunities, so its time to throw away dogmatic platitudes like, “bidding on brand terms is always worth it because they’re cheap anyway and competitors might do it if we don’t” or “never bid on brand terms because you should rank highly for them anyway”. Instead, approach each case with an open mind and do your best to gather data to support your eventual strategy. Geo exclusion analyses are one way to do just that.