If you could pay your bills in clicks you would be rich.

But you can’t…. and for that reason your current PPC campaign is failing.

Looking at your data you see that users do type in your keywords, do click on your ads, and do go to your landing page. Then, for reasons you don’t completely understand these users just vanish.

You know you need these users to fill out your forms and pull out their credit cards, but you can’t figure out what stops them from converting.

Your features and benefits look good, the user’s keyword intent matches your offer and your landing page is clean and conversion focused.

So what is the problem? What force is preventing these users from turning into customers?

This article will help you understand this negative force that prevents users from converting, and it is something that you will be surprised that you ever overlooked in the first place.

You Only Focus On The Benefits

When you first started learning about marketing, the very first lesson was probably about the difference between features and benefits and the need to include benefits in every marketing message you present to the consumer.

Utilizing benefits is a sound, field-tested, marketing strategy – so when you created your ads and landing pages you made sure to exclusively focus on them. Each benefit statement spoke to the user about how their life will markedly improve by using your product or service. These benefit statements are probably what produced such a high click through rate on your ad in the first place.

While including benefits helps your marketing messages be more persuasive – focusing only on benefits means that you are only focusing on half of the equation.

While users are interested in what’s in it for them (benefits), before they convert they get laser focused on avoiding the potential pitfalls of doing business with your company.

What you need to do to complete the marketing equation is lower the perceived risk.

Lower The Perceived Risk

The Internet is still seen as a risky place to users.

In fact, according to a survey recent survey the number one and two fears in America are:

- Identity theft

- Cybercrime

That’s right – not sharks and not terrorists but identity theft and cybercrime.

So, when you ask users to provide you with personally identifying information and/or credit card information you are literally tapping into their two worst fears.

Think about the risk from the user’s perspective and why they will click on an ad but may not fully convert. There is very little to no risk to clicking on an ad but filling out a form and providing credit card information is potentially full of risk.

While you know that your business is stellar and unlike the Patriots you play by all of the rules – the person who simply clicked on your ad doesn’t know that.

Doing business with your company may not be risky in reality, but all that matters is the user’s perception of risk for conversions.

4 Ways To Lower The Perceived Risk

Now that you know understand why you need to lower the perceived risk – here are four ways to accomplish this task.

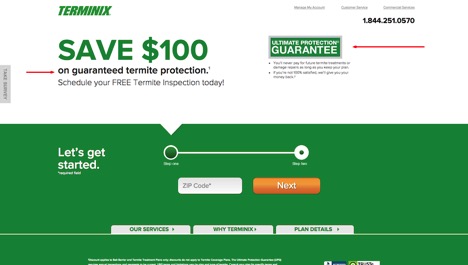

1) Lower Perceived Risk With Guarantees

How much does adding a guarantee lower the perceived risk to potential customers? Enough to raise online sales by 49%!

A split test conducted by conversion rate experts found that simply adding a guarantee to the webpage increased sales for a client by 49%.

A guarantee essentially removes all perceived financial risk.

It says to the user that not only do you believe in your business, but also you believe in it so much that you are willing to pay the customer back fully (and in some cases double) if you don’t fulfill on what your business promises.

As an additional note in the CRE study, they had a great recommendation to make your guarantee positive. Rather than saying “We guarantee you won’t get cold pizza” spin your guarantee to state something positive like “We guarantee you will love our hot, fresh pizza.”

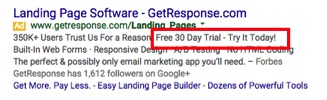

2) Lower Perceived Risk With Free Trials

One of the most effective ways to alleviate perceived risks is to actually eliminate all of the risk on the user’s side.

This can be done by utilizing a free trial (the risk is even minimized more if no credit card required). By providing a trial offer you (as a business) shoulder all of the risk. This gives your potential customers a chance to try out the product or service without having to make a risky commitment or risking financial loss if the product or service is not up to expectation.

An additional benefit of allowing free trials is that it allows your company to begin building a relationship with the potential customer. As this relationship grows through the initial onboarding process the potential customer begins to trust your company more, which – you guessed it…. lowers perceived risk!

3) Minimize Perceived Risk By Removing Form Fields

When you think about form fields from the user’s perspective, each additional field increases the perceived risk.

- If you ask for their phone number there is a risk that they will get uninvited phone calls

- If you ask for their physical address there is a risk for unwanted bulk mail

- If you ask for their email there is a risk for unwanted spam email

The less information you need to ask, the less perceived risk there is and the higher the conversion rate will be.

In fact, removing form fields is so effective that HubSpot found that reducing even one form field increases the conversion rate by 50%.

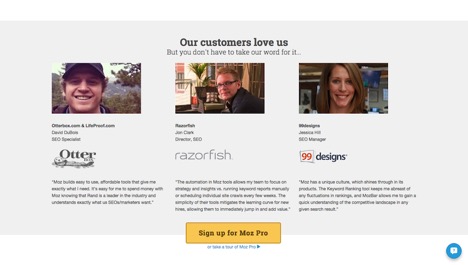

4) Lower Perceived Risk By Adding Social Proof

Social proof is a principle put forth by Robert Cialdini as one of the six principles of influence from his (very helpful!) book Influence: The Psychology of Persuasion.

The principle basically states that people feel comfort when they see that others have used and are happy with a product or service. Social proof says it worked for all of these people so it should be of no risk to you!

Think of how important real social proof is from your own experience – for example getting a new haircut, which can be a risky venture. If someone you know and trust says that they had a good experience, you perceive it to be a less risky purchase. If five people you know and trust say it was a great experience you view it as a non-risk.

You can demonstrate social proof through:

Testimonials

Testimonials are a great way to let customers speak to potential customers and share how they benefited from your business. It also alleviates perceived risk because obviously your business would not receive a testimonial if you had ripped them off.

Testimonials are also extremely powerful – in one study simply adding three testimonials to the landing page increased the conversion rate by 34%!

Accreditations

Accreditations reduce perceived risk because they are from an independent third party, which is staking their reputation that your company is reliable and worth doing business with. Accreditation can include companies like the Better Business Bureau or online accreditations like Veripay. The user perceives the risk to be less as these accreditations have to be earned and the companies that earned them have been heavily vetted.

Reviews

This lowers the perceived risk to the user because they already trust those publications.

My company, Nerds Do It Better, is partial to using reviews with Google review extensions, which show the reviews from independent, verifiable third parties. We have found review extensions increase click-through rates and we believe this is because the companies in these ads are seen as less of a perceived risk with which to do business.

How have you lowered the perceived risk for your users and increased conversions?