Former Hanapin employee and current Bing Ads Account Manager, Eric Couch, stops by the blog to share current Bing Ads marketplace trends.

In all of my time working at an agency, and even beyond that now working at a Search Engine, I’ve learned there’s one universal truth: advertisers love getting competitive insights and learning about greater trends for their industry in general.

It makes sense, and I’m right there with you! Understanding how your competitive landscape is changing and how the auction marketplace is shifting around you can be critical. It can help you diagnose account performance woes- as well as ensure that you don’t miss out on actionable opportunities.

But finding these insights can be a real challenge. There are definitely excellent paid tools that can help you, and you can create some pretty handy makeshift reports with a little Excel know-how. However, today I’m hoping to add one more tool to your competitive toolbox: Bing Ads Marketplace Trends.

What Is It?

Simply put, Bing Ads Marketplace Trends is a one-stop shop for industry trends- you can examine industry-wide KPIs and device metrics across a total of 34 different verticals, and numerous relevant sub-verticals beneath that. Verticals (and sub-verticals) like:

- Education (including segments for Higher Education, Vocational Training, and K-12)

- Real Estate (includes property listings, real estate agents, and legal services)

- Clothing & Shoes (children’s clothing, menswear, outerwear, etc.)

- Financial Services (banking, credit & debt, investing)

The Marketplace Trends reports then provide you trends and actionable takeaways in the following ways:

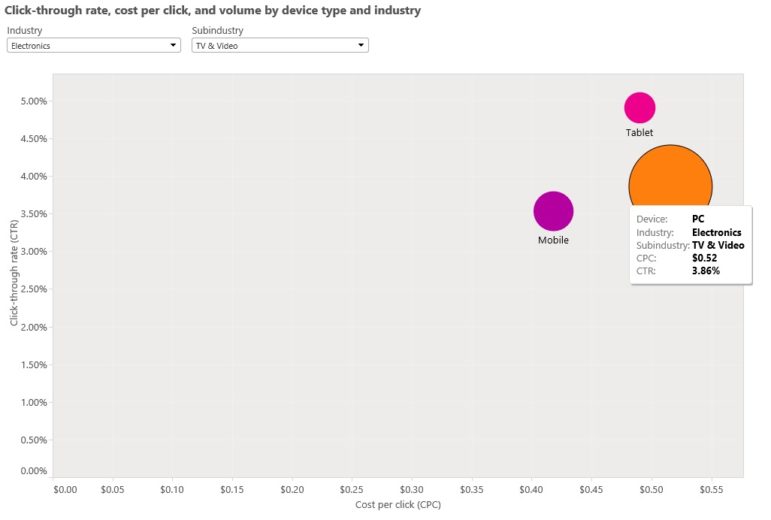

1) Industry-Wide Benchmarks At The Device Level For Your Click-Through Rate And Average Cost Per Click

From this quick snapshot, I can immediately compare my own metrics in the TV & Video subindustry- how does my Average CPC compare to the industry standard? And my CTR? In addition, the circles are an indication of relative volume… meaning that my mobile site had better be up to par here, because it’s surpassed tablet volume as a traffic source for my business.

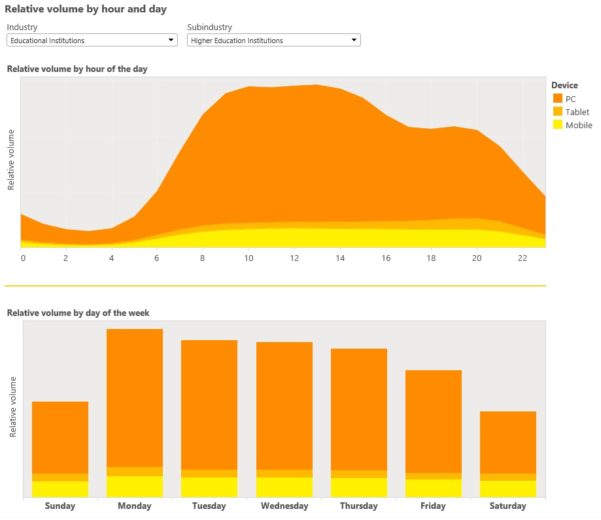

2) Industry-Wide Insights At The Device Level For Your Relative Traffic Volume By Hour Of Day And Day Of Week

Definitely my favorite of the bunch- this report helps you to shape your dayparting strategy, especially if you (or your client) haven’t tried PPC on Bing before. In the top graph, we see a very compelling case for the following ad scheduling ideas:

- A bid modifier for the hours of 10:00 PM – 6:00 AM, as traffic volume nosedives sharply from about 10:00 PM on.

- Another bid modifier applied to the hours of 5:00 PM – 9:00 PM, as traffic volume lowers there. (But you might want to up your tablet bid modifier, as some of the search volume goes to that source in the later hours of the day.)

- A positive bid modifier applied to the hours of 9:00 AM – 4:00 PM, as traffic volume absolutely goes through the roof in those hours.

We can apply a similar bid modifier logic to the day of week report- Monday is our clear winner from a volume standpoint, but Tuesday, Wednesday, and Thursday are right behind it. As for Saturday and Sunday… well, let’s just hope that you aren’t banking on those two days to help you spend your budget.

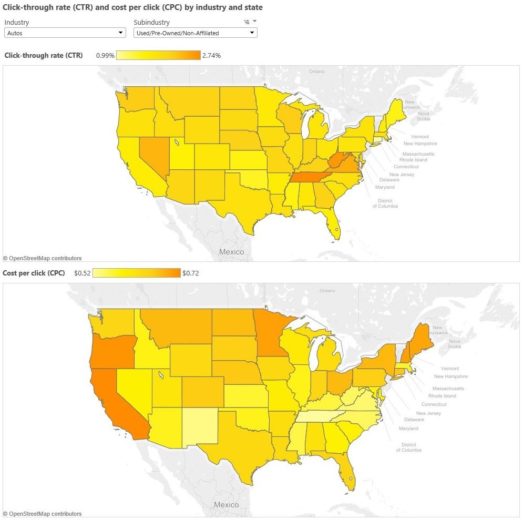

3) Industry-Wide Benchmarks For Your CTR And CPC By State

Much like the first report, this can help you benchmark your own metrics, as well as provide you with some surprising insights about your industry. Two things that pop for me in the above map: Tennessee’s absurdly high CTR yet absurdly low CPC, and Oregon’s ridiculously high CPC. I’ve been to Portland. Not the biggest car market I’ve ever seen, so the level of competition is surprising.

All in all, it’s a handy, free tool that provides you with some helpful insights- insights that can help you set CPC and CTR benchmarks for your own accounts, that can help inform your overall dayparting strategy, and that can help you gain useful geographic insights. (Or, at the very least, gain some great pub trivia knowledge about used car CPCs in Oregon.)

What about you, PPC Heroes and Heroines? Have any useful competitive tools to share? Do you know why Oregon average CPCs are so high for used cars? Let us know in the comments (seriously, I’m dying to know the answer here) and, as always, thanks for reading!