Series week continues as we assess PPC management across different industries. This morning Rachael covered PPC for the IT and Technology industry. In case you missed it, yesterday Matt discussed PPC for the legal space. And this afternoon, Sarah is covering PPC Inside the Financial Services Vertical.

I spent 7 years working with insurance and banking PPC accounts and prior to working in search marketing I worked for a captive finance company. Admittedly there were many times I wished I could have been working for a designer clothing label, or a sexier vertical, however, the industry is dynamic with high customer lifetime values. The industry is also data driven and therefore the cost-per-click (CPCs) for generic keywords are some of the highest in the PPC trade.

Pay-Per-Click Sophistication & Technology

With geotargeting we have the sophistication to design campaigns to only show in certain locations and DMAs. You can choose to focus on entire countries, cites or even set up campaigns using radius targeting.

As an example, let’s look at how this technology could be extremely valuable to an insurance client. It is fair to say that a higher net-worth customer would insure a more expensive house, multiple vehicles, or even entire businesses. Then why not target the campaign accordingly? After all, the ROI on these campaigns would be higher. Let’s consider a banking campaign. If the bank has the data to determine that customers in certain zip codes not only pay loans back sooner, but take out larger loans, then why not set your campaigns up to maximize ROI? I will tell you why – redlining.

Redlining started in the banking industry and pertained to mortgage lending but it is a major factor in the insurance industry as well. Redlining at the most basic level would be if a company declined any customers within a geographical location. This practice is not only unfair but the result can affect minority groups. The government is also involved. There are acts in place to fight this type of lending such as the Fair Housing Act (FHA) as well as insurance regulations preventing these actions.

Deciding to not show ads in certain demographic areas is equivalent to not having a storefront. Consumer action groups are on the lookout for these unfair lending practices, and as an agency our job is to protect and advise the client of the ability and corresponding risk and PR nightmare that could result in this type of campaign targeting.

Agility

It is important to be agile while working in the financial services industry. You need to be agile in process as well as campaign adjustment and budgeting.

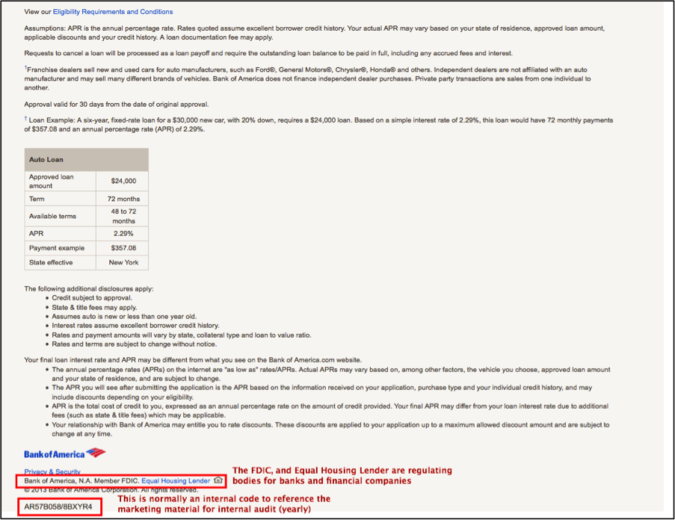

Interest rates change daily, and rates are the selling point. Ad copy rollout needs to be fast, accurate and smooth. Advertising the incorrect interest-rates can have a profound effect on the bank. Landing pages need to be updated with the proper interest rates. When a rate change takes effect there is not enough time to have a developer or designer update the code or images on the page. You need to be able to update the landing page in an instant. Most of the time this is done through a content management system or dynamic code on the pages that can be launched swiftly.

You also need to be agile when it comes to campaigns as banks have capital requirement. Capital and reserve requirements require that banking balance sheets have certain ratios of loans to deposits. If a bank were to become over leveraged the bank could conceivably go out of business.

PPC is impacted in that there needs to be speed with regards to campaigns. One month the account may have heavy spend on the deposits side, and the next month the account may need to promote loans more heavily. Again, these are regulations, so it is important to act quickly when the client asks that loans be paused or interest rates be updated across the ad copy, landing page, and other advertising channels.

Shopping Mentality

Let’s face it; it is a royal pain to change insurance companies and banks. To change banks, you need to move around checking accounts, savings accounts, and sometimes mortgages, car loans, and home equity lines of credit. Changing insurance is even worse as most established consumers have car, home, and perhaps business insurance wrapped up with one company.

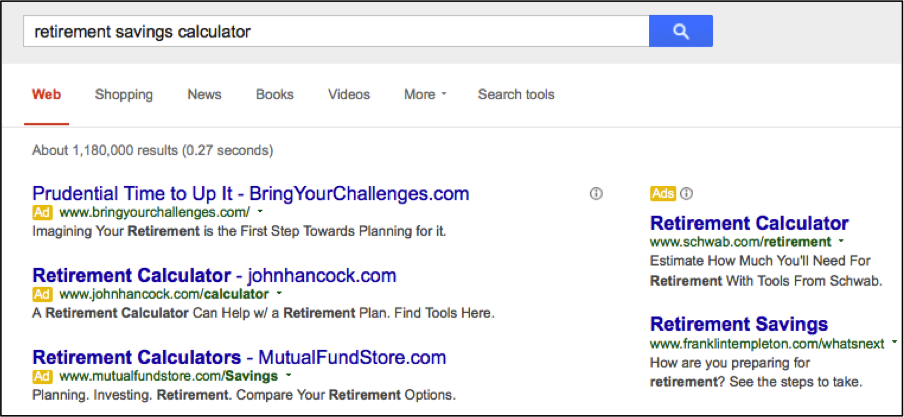

Working in PPC for any industry you need to understand the consumer, but for financial products shopping occurs around life events, marriage, first home, birth of a baby, divorce and so on. Designing your campaigns and targeting customers around their life stage is an important aspect of this industry.

Tools and Education

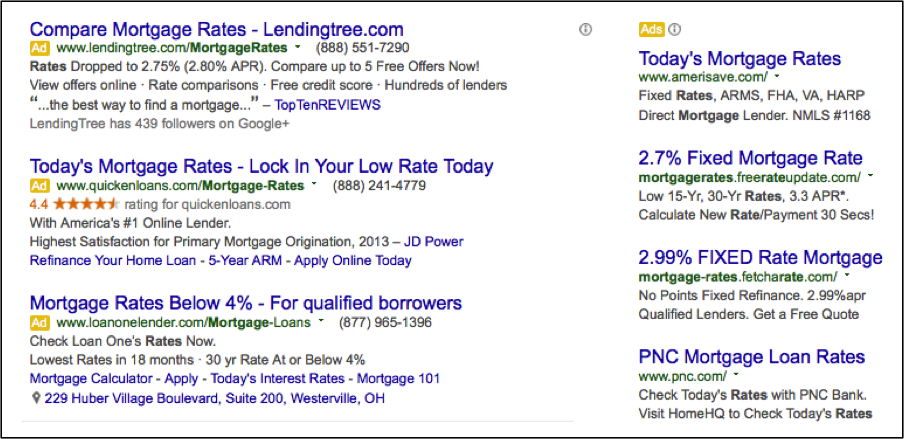

Financial and insurance products can be confusing to the consumer. The financial industry is also shopping and comparison oriented. In this market consumers typically compare different products at length before making the important conversion decision.

As marketers fighting for share of the consumer’s wallets, this is an industry where it is not un-common to pay for the promotion of educational content. In this industry the clients are willing to pay to send potential consumers to tools, and interactive experiences. If a potential customer interacts with the brand not only is the company able to obtain customer data, but also the potential for the conversion is increased.

Customer Lifetime Value

The financial industry is shopping and comparison oriented. In market consumers typically compare different products at length before making the important conversion decision. When they do convert the relationship is generally longer term and growth oriented.

Online, By Phone, or By Agent

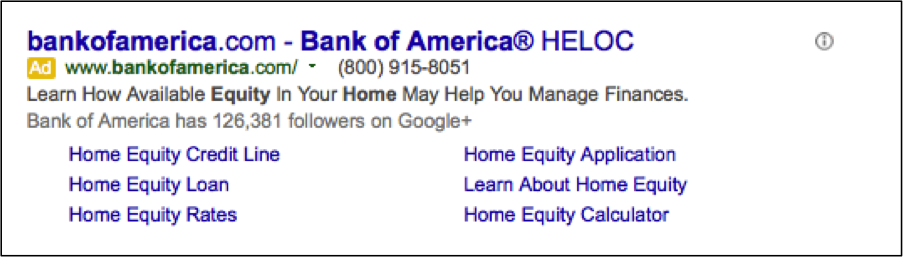

When talking about financial products the most desired customers are going to hold multiple products. This means the conversion may take place online, but customers with more specific needs will need to call or work with a financial consultant, banker or agent to convert.

Many clients begin online with a basic product. For example many students obtain their first checking account in college and remain loyal customer for a lifetime. It is crucial that the customer be able to convert in the channel that aligns with their goals. These conversion paths need to be weighted when building out financial accounts and campaign structures. For mortgages in particular consumers would never fill out an application unless they were certain on the mortgage lender. The CPCs are still high because consumers do most rate shopping online before making the first phone call and leading to conversion.

Rules, Regulations, and Disclaimers

The Financial Services industry is heavily regulated. All landing pages need to have the appropriate disclosures and disclaimers. You will also notice that all landing pages have a digital number at the bottom. Most large banks also have a process where every landing page goes though a legal and compliance review process. These timelines need to be built into campaign launch projects and accounted for when planning paid search initiatives.

Conversation and Data Tracking

As discussed earlier, customers who need multiple financial products do not convert online, however, PPC is a very large driver and initiator in the process. The company needs to have good back end systems and processes to justify PPC spend. Furthermore, because switching financial institutions can be so cumbersome often times one member of the family does the shopping and quoting and the conversion to a policy or banking product falls under a different name. Large companies use complex matching technology to match this household data with accuracy.

Final Thoughts

The financial industry is great for PPC because it is so data driven. It is an industry that employs hundreds and thousands of actuaries, data analysts and risk analysts. More than likely if you have a client in this industry they are going to be empowered by data.

Lastly, it is an industry where consumers are engaged in the shopping experience. Consumers spend time shopping, comparing and asking questions before the conversion takes place, so the PPC campaigns can be layered and more tailored to the consumers point in the marketing funnel.