A few months ago, the Hanapin team conducted a thorough competitive analysis for one of our largest clients. This particular client wanted to know how they fared against their competition in the Google marketplace when showing in the same auction. Today, we’ll discuss both how the analysis was conducted and how we used it to drive strategy.

Pulling the Data: The Auction Insights Report

The Auction insights report was used as the basis of our competitive analysis. Accessing this data is straightforward and instructions direct from Google can be found here.

- Sign into your AdWords account

- Click the Campaigns tab

- Click the Keywords tab

- Select a specific keyword or set of keywords

- Click the “Details” box at the top of the statistics table

- In the dropdown menu, under “Auction insights,” click “All” or “Selected”

- You’ll now be taken to your Auction insights report. Note: only keywords that meet a minimum threshold of activity will have the Auction insights report.

Conducting the Analysis

The competitive analysis was conducted on multiple levels. An account wide analysis was initially done to identify the client’s top 10 competitors. Although this information was good to know, it turned out the data was not very helpful as the list was too broad and not very insightful. We didn’t know if the top competitors were competing against our client for every product in every geographical location, or some products in some locations.

In order to get more actionable data, the team then dove into a product category analysis. This analysis produced more useful data because the competitor list was in direct relation to a specific group of products. We could now begin to craft strategies to position ourselves against these competitors. However, what we didn’t know is if our competition varied by product.

What we really needed was intelligence about competitors on a product-by-product basis. Knowing whom the competition was, and how they were positioning themselves at this micro level gave us clues regarding how aggressive they were going to be to gain market share. If we only depended on account wide or even product category data, the real competition would be masked.

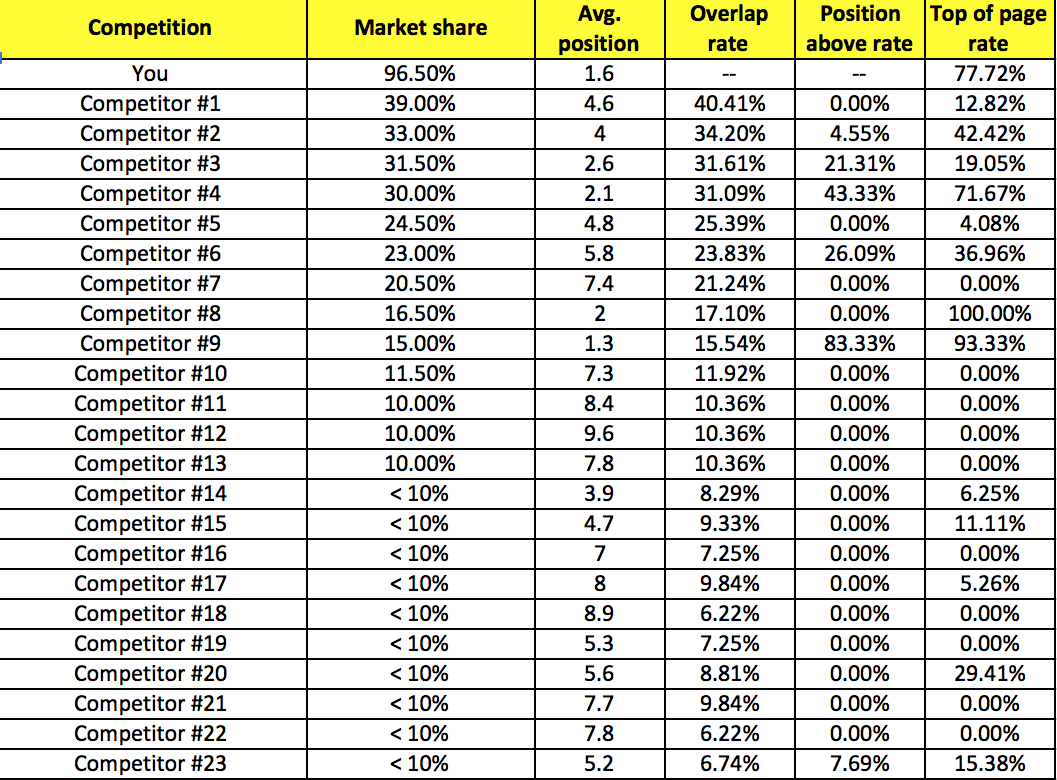

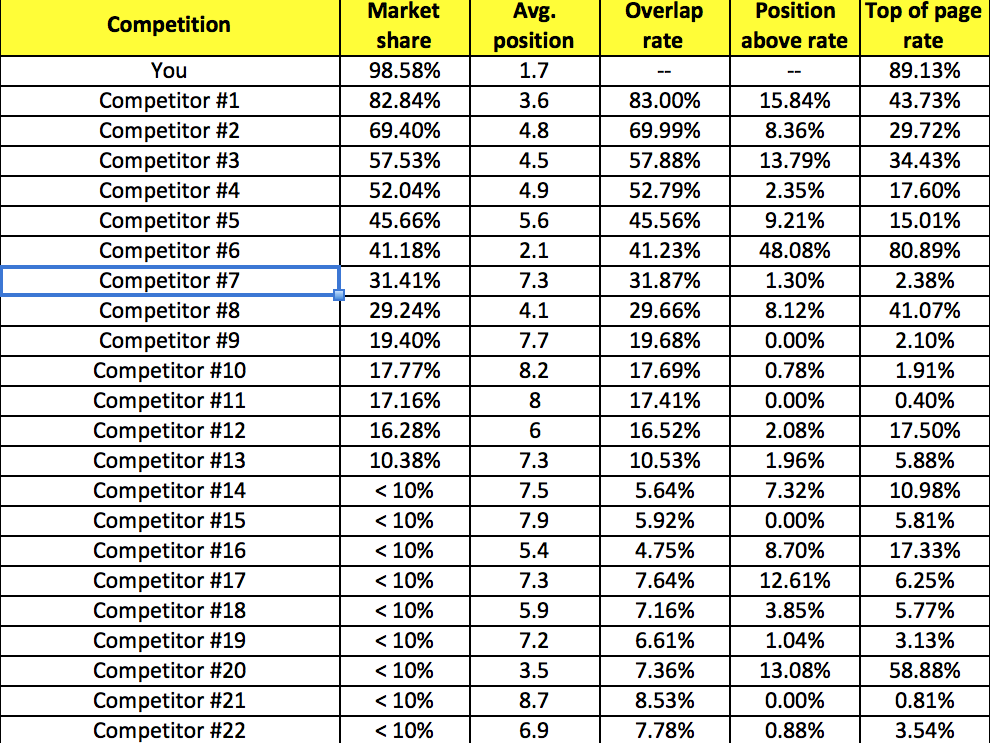

Below are examples of competitor reports on the account, product category, and product level. The examples highlight how much the data varies as we drilled into each level of the analysis.

For easy reference, I have also provided definitions of each report field.

Competition: ‘You’ is your organization and will always be the first line of data. Your competitors will be listed below.

Market Share: In the Auction Insights report, this field is known as impression share. We renamed this field ‘market share’ to provide a business context to the meaning of this data for the client’s executive team. Impression share is the percentage of time your ads appear in an auction in relation to the total amount of auctions available.

Overlap Rate: This is the percentage of time competitors show up in the same auction as you.

Position Above Rate: This is a representation of how often a competitor ranks above you on the results page.

Top of Page Rate: This is the percentage of time competitors appear above you in the search results.

Account Wide Competition

Product Category Competition

Product Level Competition

How Did We Use This Data?

We used the analysis to revamp our competitor keyword strategy. Prior to this deep dive analysis, the strategy was to:

- Comb through search query reports

- Identify converting queries with competitor names in them

- Create competitor ad groups with keywords from the SQR’s

- Load them to every location

Although the queries we identified converted, deploying this strategy account wide actually reduced conversions and dramatically increased cost per lead. This process failed due to the notion that when a competitor had a strong presence in a location, users would click our client’s ads out of curiosity but wouldn’t convert. Most likely, they would convert on the site of the competitive keyword they typed in. CPC’s were also much higher than expected. This is due to the low quality scores of these keywords. The conversion rates were not high enough to mitigate the high costs these keywords were accruing.

So how did we revamp our strategy? We identified across product type the geographical locations our client’s competitors were not advertising. This allowed us to take advantage of the available traffic on competitor names but not have to compete with competitor ads. If a competitor was competing in the same market as our client, we did not bid on those competitive keywords.

Conclusion

Understanding your client’s competitive landscape is key to running a successful account. Knowing who is competing against your brand, how competitors are positioning themselves, and where they are appearing in search results can help guide strategy. For example, it’s important to know if a competitor is trying to take the #1 position on your brand keywords. Not paying attention to the competitive landscape can lead to giving up ground and losing out on growth opportunities!