Over the past month the digital marketing industry has been alight with discussion of how SGE may impact Google search results.

While SGE is still very much in testing, the nature of the interface and its physical appearance have caused advertisers to think about the impact it could have on potential revenues, and what the future might look like for them in the event of a full roll-out.

Let’s take a look at what SGE is, the impact it’s likely to have on paid search and what the future might look like for those involved.

What is SGE?

SGE or “Search Generative Experience” is Google’s new AI-driven search function. It’s changing the way that search results displayed and how we interact with them. SGE provides users with clear and concise summaries of their search queries directly on the results page, eliminating the need to click through multiple websites. This is achieved by the AI processing your search terms and generating informative responses that condense key takeaways, answer your questions, or even offer step-by-step instructions.

In addition to providing answers to user’s queries, the interactive nature of the interface allows users to ask follow-up questions based on their answers all in one place.

The result centres at the top of the page, pushing down traditional organic listings and in some cases re-arranging the existing positioning of ads. As a consequence, this rollout has the ability to substantially impact existing traffic and conversion levels.

It’s important to note that SGE is still under development, currently in a testing phase, although currently rolling out in the US.

What does SGE mean for PPC?

While it’s worth noting that SGE is still in its infancy and we aren’t 100% sure what the final product will look like, there is heated discussion around it leading to reduced real estate and fewer top ad slots. This could lead to increased competition for ads and a potential increase in costs.

In its current format SGE could impact PPC in any of the following ways:

- Increased competition for existing ad slots, if there are fewer/in different positions

- Increased competition on PPC overall if businesses who currently rely on organic search need to increase or switch to paid advertising to make up for any losses

- Lower CTRs, if users find the answer to the query they are looking for within SGE and may not need to click on an ad to get the answer to their question

- Increased engagement, if AI summaries keep users engaged at the top of the page for longer and increase potential exposure to ads

- Shifting their focus from traditional CTR metrics through to CPA metrics – especially if click volume is lower than it has been in the past

- Forced change of strategies, if there are sudden drops in revenue streams. Advertisers will need to be on the ball to adapt quickly

Regardless of the impact of SGE, there’s the potential for significant disruption to existing campaigns so it’s critical that advertisers are prepared to adapt.

Could SGE lead to an increase in clickless searches?

One of the main impacts of SGE is the concept of a clickless search. That is one where a user finds the information that they are looking for within the SGE box and doesn’t end up clicking on a search result (either paid or organic). In turn, this could lead to a decrease in CTR for PPC ads, fewer people landing on the website itself, and a subsequent drop in conversions. Even back in 2020 nearly 65% of searches ended in a clickless search but will SGE ramp this up even further?

This may cause advertisers to rethink their strategy, especially if they are targeting conversational queries. Conversational queries in many cases are quite easily answered by SGE, but providing an actual service or product is something that will require a user to still click through to a website. As a result, we may see a drop in advertising around the more conversational-based keywords and an increase in focus on service/product-based, purchase-intent heavy queries.

Ad placement considerations

This current iteration of SGE has shown that ads can be placed both above or below the SGE responses. In some instances we have seen only one ad above the result, in others there can be more than one. With standard results currently showing three, this does have the ability to have a significant impact on ad performance across the board.

According to a new study by SE Ranking Shopping ads appear above the SGE snippets over 80% of the time, with fewer placements in the sidebar or below the SGE result. By contrast, text ads were most often at the bottom (35%), followed by the top (23%).

In 27% of cases from the above study, no ads accompanied SGE snippets, but that’s not to say that these weren’t keywords that didn’t naturally generate top of the page ads already.

Does this mean that we are likely to see retailers pushing more heavily on Google Shopping, as opposed to the traditional text ads for products? What is the likely impact of this?

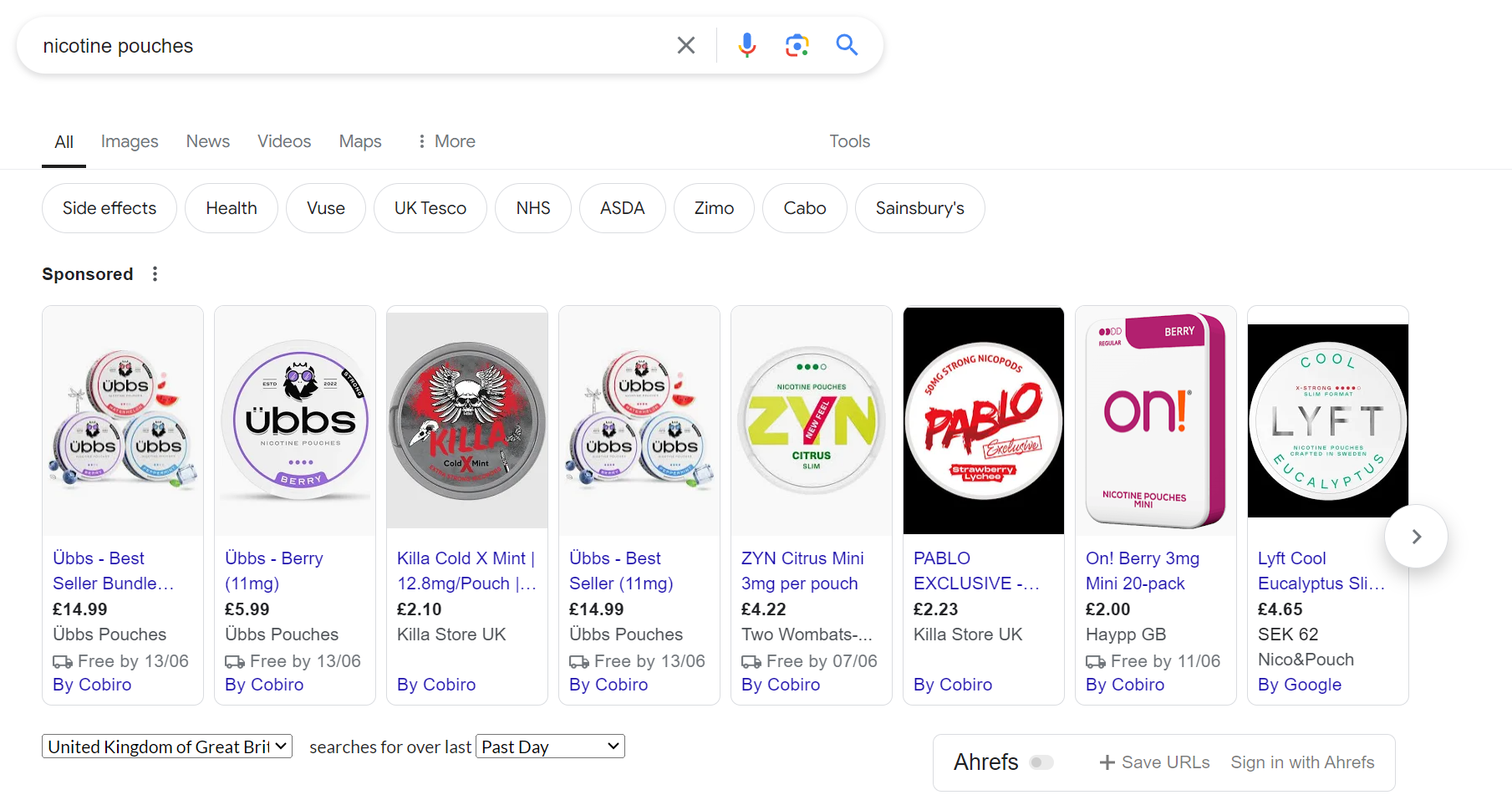

In some sectors like searches for “nicotine pouches” we already see the absence of the “Google Shopping” tab, which again is increasing competition.

Key brands in this sector like Alternix will need to consider not only how their split of budget on Google Shopping vs text ads sits within the SGE format, but also how they can further optimise to maximise this real estate on search results. Proper optimisation of product feeds and overall Google Shopping campaigns will be more important than ever.

Regardless of what the end product looks like, in its current format this does have the ability to make the current Ads auction significantly more competitive.

Will a decline in organic traffic result in more PPC?

PPC could be seen as a reaction to a drop in organic traffic, but it isn’t necessarily always an automatic or ideal solution. For websites struggling with organic visibility post SGE it could be that we see an influx of PPC advertisers potentially pushing up costs as the ad auction becomes increasingly competitive.

In many cases PPC isn’t always a natural transition either, and will naturally lend itself to certain sections of the market more than others. If you have a very low margin or a small AOV then in many cases PPC might not be a workable option – in these situations marketers will need to evaluate a range of different channels to find the one best suited to them.

Preparing with channel diversification

When looking at the different channels that are available, diversification will become more important than ever, as we look to maximise exposure for brands using perhaps a broader variety of paid media channels than previously. There will be a need to get to grips with what those funnels look like at each stage.

Social media advertising and paid social channels will likely see an increase in activity, and could prove popular for brands who pushing for additional visibility at the top of the funnel. We may see social, paid and PR come together to provide more of an overall branding experience. Being able to understand and report back on the multi-channel funnel will become essential with the rollout of SGE, as will the need to be prepared to diversify to retain and attract new traffic.

A thought for businesses who can’t use paid advertising

Finally let’s spare a thought for the impact this might have on businesses unable to employ paid advertising as an alternative to SGE. What will the future look like for companies in these sectors? If we’re delivering a multi-channel strategy how can we approach it to ensure we continue to promote visibility when real estate is continuing to shrink?

For websites like Vape Superstore who currently rank well for high volume terms like “disposable vapes”, the potential impact of SGE could be substantial. Without any Google Ads on the search listings, the CTR can be as high as 45%, so replicating this real estate with an AI-driven SGE result could have a substantial impact on CTR without the backup option of PPC or Paid Social available.

One interesting question here is what SGE will look like in sectors that are product driven but can’t shift to Google Shopping or Product Listing Ads? How will SGE deliver a viable user result (i.e. a product) by using AI in this space?

Summary

Regardless of the eventual SGE outcome, there’s no denying that businesses will need to diversify traffic sources and focus on brand building to combat potential losses from the rollout. The impact of this diversification will spread far beyond Google Ads.

SGE will challenge businesses to use a multi-channel approach across their paid advertising like never before. As advertisers we need to be prepared to diversify to make the most of the traffic that is available.