The paid search industry was abuzz on Friday, as news that Google would be removing sidebar ads and adding a fourth paid ad above the organic listings was announced. In addition, up to three ads will continue showing below the organic listings while Shopping ads will remain unaffected (for now).

Naturally, paid search specialists were taken by surprise at this announcement as sidebar ads have been a staple of AdWords since the program was launched in 2000. In reviewing the recent history of AdWords releases and updates, this move doesn’t come as a total shocker, but it is quite curious.

Any paid search specialist would agree that ad exposure above the organic listings has more value than the sidebar. The main reason being that these ads are more eye-catching than sidebar ads. After all, ads above the organic listings can:

- Utilize all ad extensions, occupying additional search real estate

- Make use of extended headlines where description line 1 is formatted with the same emphasis as the headline

- Show the Display URL in the headline

- Have description lines 1 and 2 show as a complete sentence

Aside from showing a limited number of ad extensions, sidebar ads don’t have the ability to utilize these features. That’s why when reviewing your “Top vs Other” segment, CTR is generally significantly higher for top ads in comparison to the sidebar. This trend doesn’t mean that conversion rates are higher, but top ads allow a better chance for ads to be clicked.

As you’ve probably guessed, showing ads above the organic listings requires higher bids. Bidding isn’t the sole factor when determining ad rank, however, it is a major consideration and for highly competitive terms, a reality. The concern is that budget-constrained advertisers may get pushed out of more auctions. Though this thinking is a bit extreme, it’s not wrong to conjecture that many advertisers will see at least a small traffic drop.

Implications

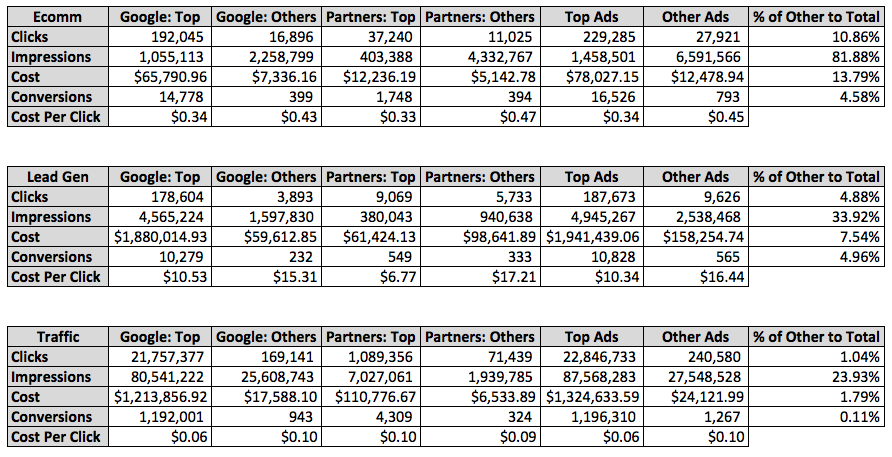

In order to see what the potential impact of losing sidebar ads would have on accounts, we reviewed three types of accounts during the time period of 8/1/15 – 1/31/16. One of the accounts was ecommerce, one lead generation, and the final account geared toward accruing traffic. We reviewed the Search Network “Top vs Other” reports for both Google and the Search Partners. An important item to keep in mind is that some Search Partners like Amazon don’t have sidebar ads, but only show paid listings below the organic results. In these cases, “other” doesn’t mean sidebar, just not at the top of the page. Here’s what we found.

Here are the key takeaways.

1) “Other” Conversions Are Low

In all three accounts, conversions from the “other” category (mostly sidebar ads) accounted for less than 5% of overall Search Network text ad conversions. What is interesting is that “other” Search Partner conversions were comparable to “other” Google conversions. In the ecomm account, Partners saw five fewer conversions while in the lead gen account Partners accrued 101 more.

The lead gen account actually had a better conversion rate for “other” ads. This fact isn’t surprising since landing page experience is a huge factor in getting the conversion, but it was interesting nonetheless.

2) Impressions Are A Big Deal

In all accounts, “other” impressions were at least 23% of total overall impressions. The traffic account had the lowest percentage while nearly 34% of lead gen impressions came from “other.” Remarkably, almost 82% of overall impressions in the ecomm account originated from “other” ad placement. The caveat is that few Search Partner sites show Shopping ads. Thus, Shopping ads would have potentially replaced the text ads, resulting in fewer “other” impressions.

If we just look at the traffic and lead gen accounts, it’s still a big deal that one out of four impressions was the result of an “other” ad placement. This data suggests that Search Partners account for a fair amount of exposure, even if some sites don’t show sidebar ads. The flip side, however, is that “other” clicks are low across all three accounts, indicating that even though the ads are getting exposure, users may not be seeing them.

3) “Other” Cost Per Clicks Are More Expensive Than Top

With “other” ad placements being in lower positions, one would expect that the average CPC would be lower than top ads, but that is not the case. For all three accounts, Google only “other” ads saw significant increases in CPCs against their top ads counterparts. In all but the traffic account, Search Partner “other” ads also saw substantial increases in comparison to the top ads. Though competitive bids are imperative, the data suggests the top ads have lower CPCs due to high relevance.

Final Thoughts

Many advertisers will most likely notice a decline in overall impressions due to this announcement. That decline will likely come more from Search Partners than Google search. Having made this statement, it is unclear how many ads will truly be removed from Search Partners since not all of these sites utilize the sidebar. Irregardless, some impressions will be lost.

It’s also possible that advertisers will see a decline in conversions, though, the impact won’t be as noticeable as the impression loss as long as the majority of clicks are coming from top ads. I wouldn’t be surprised to see account cost per conversions increase, similar to what occurred when Google Shopping became completely pay-to-play. The marketplace will be more competitive, resulting in higher CPCs and ultimately higher costs for those conversions. Just how much higher is to be determined.

Not that they weren’t before, but moving forward advertisers will have to be extra diligent in determining which keywords get higher bids. It’s a seller’s market as ad space just became that much more competitive and expensive. Combine that with the fourth ad which pushes organic results further down the page, paid search is the primary way to be seen on Google.

On a final note, this announcement is a plus for audience targeting social outlets such as Facebook and Twitter. Social paid search has long been thought of as an ancillary source of traffic, rather than a primary one. If costs increase in Google, it will force advertisers to review social platforms to make up for lost traffic.